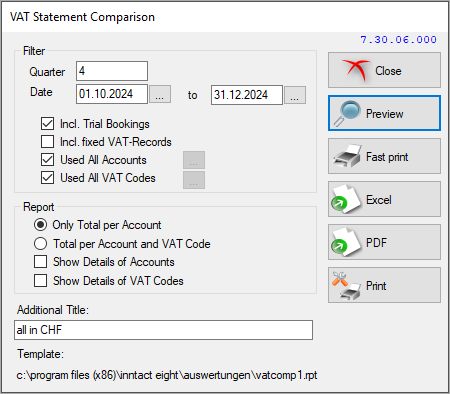

VAT Statement Comparison

- The report "VAT Statement Comparison" displays the revenues on the selected accounts along with the corresponding VAT amounts. It allows for a detailed evaluation of individual revenues sorted by the various VAT codes. You can choose either the desired quarter or any specific time period. This comparison will show any discrepancies with the VAT return.

Options:

- Incl. Early bookings --> If the checkbox is not selected, only journal bookings are already evaluated. (Book to GL).

- All accounts --> Here is a selection either all accounts included in the evaluation or the following symbol (...) is made.

- All VAT codes --> Here either all VAT codes included in the evaluation or the following symbol (...) a selection to be made.

- Total per account and Tax Code --> This function allows the analysis to make it more detailed. Per account will then be sorted and evaluated based on VAT code.

- View Details --> Displays additional details about each item on.

- Show details of the VAT codes --> This selection makes it next to the Tax Code and the description of which is recorded in the master data (VAT) table view in evaluation.

- Additional titles --> Adds a title below the additional title.