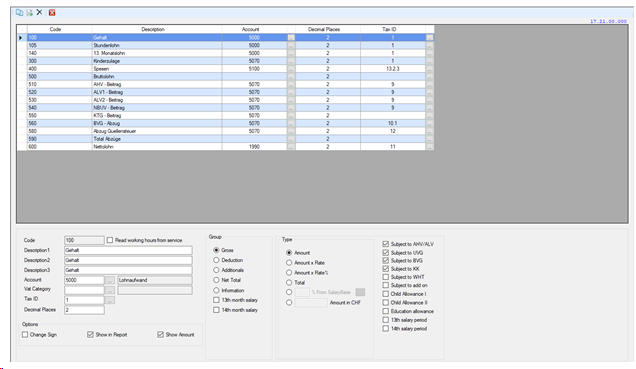

Salary Types

If you copied from one of the client base clients, the most important wage types will already be available. You can edit or add new wage types.

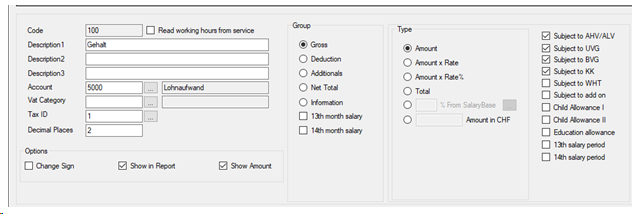

The wage type table contains all the information of a wage type. The wage types are grouped into gross, deductions, allowances, and net information. Each group contains various information such as input type/total, subject to AHV etc.

Grouping

Gross (e.g. monthly wage)

All wage types that are needed for the calculation of the gross wage.

Deductions (for example AVS)

All wage types that are needed for the calculation of deductions.

Additional (e.g. expenses)

All wage types that are needed for the calculation of surcharges.

Net (e.g. net wage)

This group contains the "gross minus deductions plus surcharges" - Total.

Information

This group contains additional information, which do not require any calculation.

(Base)

Calculation

Amount (for example monthly wage)

Approach x amount (for example overtime)

Amount x% approach

Calculated (for deductions)

Total (for example gross wage)

Mind. three wage types are used for the calculation of total lines (gross salary, total deductions, total fees).

Options

Change sign (makes the possibility of a wage below the aggregates to be deposited as minus surcharge, eg overpaid expenses)

Show amount in evaluation

Showing amount

Paid (AHV, ALV, SUVA, BVG, KTG, source control)

Offsetting

Child supplement I and II (various cantons differ by age)

Education allowance

IMPORTANT: The child and education allowances are calculated from the register children for employees. If the children are entered with birth and end date, the allowances are calculated. When wage but must necessarily a fixed amount (input type / ... Total amount in CHF) to be entered.