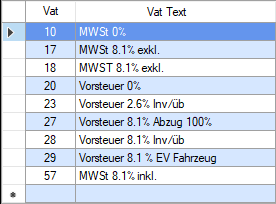

VAT Table

- Here the relevant VAT codes are managed. If VAT rates change, the changes made to a specific date can be made here.

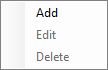

Mouse Functions

- Right click with the mouse opens the following functions.

Functions from top to bottom:

- Adds new VAT code to

- Here, names and terms are adjusted

- Removes appropriate VAT code

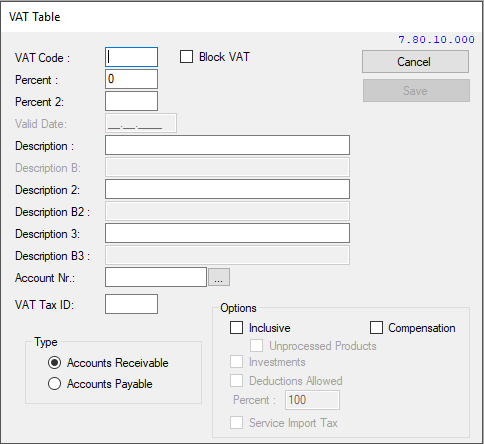

Add / Edit

- Tax code --> Here the program-internal Tax Code is set.

- Percentage --> Displays the current percentage in%. Under "new percentage" for the future, an existing VAT rate can be determined. This is then selected from the "valid from" date.

- Designation --> Can be freely selected. From the uses "valid from" date inntact the second name line.

- Account No. --> Here the account is selected on which the VAT due or the tax credit will be recorded.

- Tax code --> Here is the code, which are necessary for the VAT accounts for the Swiss Federal Tax Administration, defined (Tax ID).

- Art --> The type determines whether the VAT is recorded as a credit (tax) or liability (payable VAT).

- Inclusive --> Determines whether the VAT is included in the reserved amount or will be billed separately.

- Investment --> Determines whether it is appropriate VAT code is an investment or purchase account.

- Deduction --> If only a portion of the purchases or investments are deductible, it can be adapted here (only available with purchase codes).